Can a caregiver be an independent contractor? What you should know

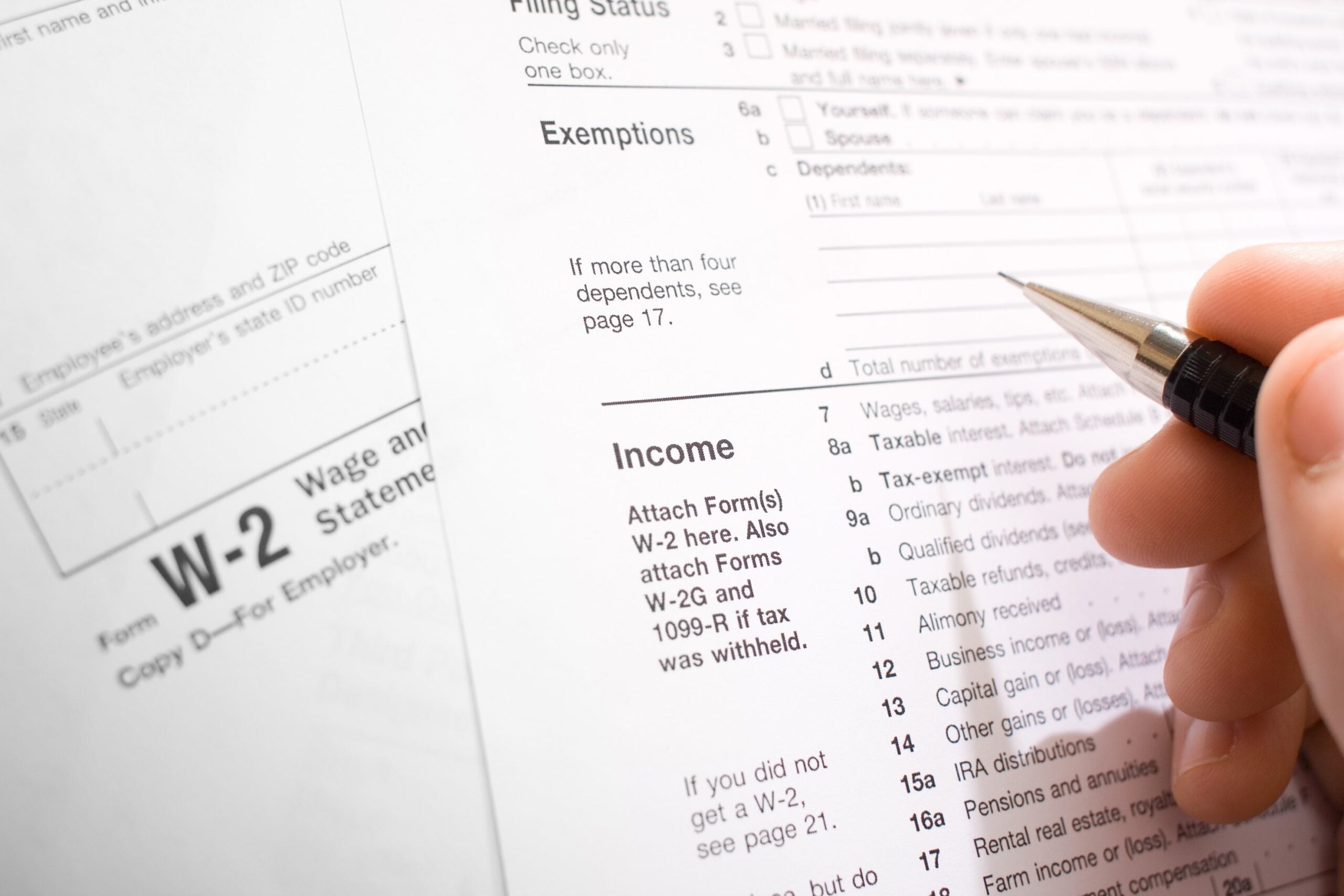

One of the biggest hurdles families face is whether you should file a 1099 or a W-2. Is your caregiver...

One of the biggest hurdles families face is whether you should file a 1099 or a W-2. Is your caregiver...

There are several benefits nannies and caregivers receive when they're paid on the books. Learn what they are and why...

As a nanny or caregiver, the IRS almost always considers you a household employee, not an independent contractor, so you...

As a part-time, after-school nanny or babysitter, you may not realize you still owe taxes — but in most cases,...

Families that need a part-time caregiver to provide after-school care may have household employer tax and payroll responsibilities.

Many families take their nanny with them when they go on vacation. But the change in work environment can lead...

How should you handle nanny taxes when you're a nanny or caregiver? What can you do if your employer wants...

Learn about the unique tax implications, payroll rules and potential tax breaks when two families participate in a nanny share.

Learn how the payroll and tax laws work for babysitters and other short-term domestic workers from the experts at Care.com...

Household employers should use the IRS estimated tax payment schedule to file taxes throughout the year instead of using Form...