Offering employee benefits is one way that employers can set themselves apart, especially in a competitive job market. The key factors to consider when providing employee benefits include: the impact employee benefits have on employer brand, the cost of offering employee benefits, which benefits are mandatory, and how to design your benefits program based on employees’ diverse needs.

1. Reasons for offering benefits to employees

To be considered a top employer, offering employee benefits is a must. People are still quitting their jobs at record rates. When asked why they quit, a desire for better benefits was the second most common reason, right after a desire for better pay. Offering a generous employee benefits package is clearly important, and will help businesses:

- Retain employees

- Save money

- Reduce absenteeism

- Increase productivity

2. The costs of offering employee benefits

Offering employee benefits is a necessary cost when it comes to retaining and attracting employees. We took a look at the data from the U.S. Bureau of Labor Statistics to better understand benefit costs. What we found is that, on average, benefits make up almost 30% of the average total cost per private industry employee. Some of that can be chalked up to mandatory benefits, like Social Security, but those required benefits work out to less than a quarter of the price tag for typical benefit costs.

The average employer has quite a bit of leeway regarding the types of benefits that they offer. But in order to appeal to potential employees, they’ll want to balance the cost of offering employee benefits with the advantages they’ll gain by being seen as a desirable company to work for.

3. Required versus optional employee benefits

There are some mandatory benefits that all employers are required to offer. This includes:

- Social Security

- Medicare

- Workers’ compensation insurance

- Unemployment insurance

Some local and state laws also require employers to offer sick leave, so check the regulations for your area to make sure you’re in compliance.

Each employer has the option to evolve their benefits strategy to use as a competitive tool to attract and retain talent, increase productivity, and improve overall employer brand by including:

- 401(k) match and retirement planning

- Vacation and sick leave

- Backup care

- Child care benefits

- Senior care benefits

- Pet care benefits

- Student loan repayments

- Mental health

- Parental leave

- Gym reimbursement

- Profit sharing

- Flexible work schedule/location

- Pet insurance

Savvy employers managing employee benefits will make sure their benefits package is inclusive of every life stage, accessible to every employee, and flexible for every work environment.

4. Aligning employee benefit offerings with employee needs

Benefits are only as impactful as their utilization rate. To drive this, it’s critical your employee benefit offerings are designed to meet the needs of your diverse workforce. Often, alignment between employer perceptions and employee needs can be found through regular employee pulse surveys.

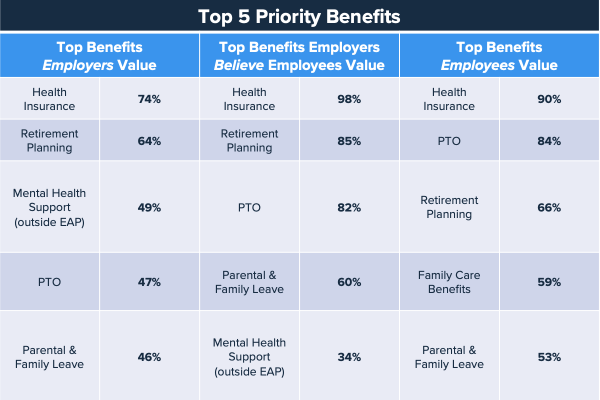

In a recent study we found that employers have a pretty good grasp on what benefits employees want—correctly choosing health insurance, retirement planning, PTO, and parental and family leave as four of the benefits that employees most want. But where they missed the mark was overlooking family care benefits, which was listed by 59% of employees as a priority for them. Family care benefits didn’t even make the employers’ top five for benefits they think employees value.

Ready to create your own employee benefit program?

Offering benefits to employees takes a lot of careful planning and consideration, but with diligence, employee considerations, and a clear strategy, you can begin designing your own successful benefits program.